Promotion Of Investment Act 1986

2 promotion of investments act 1986 date of royal assent.

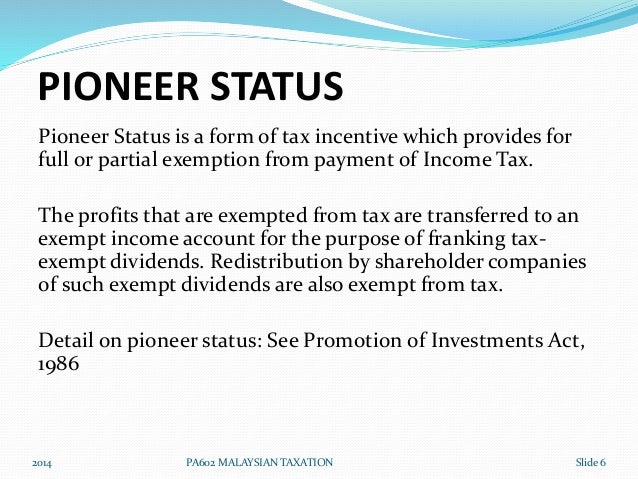

Promotion of investment act 1986. This act is called the investment promotion act b e. This act shall come into force as from the day following. Paragraph 1 citation and commencement. Promotion of investment act 1986 isnin jan 06 2020 pioneer status ps a company that is granted pioneer status ps will enjoy different degree of tax exemption depending on the types of promoted products activities as follows.

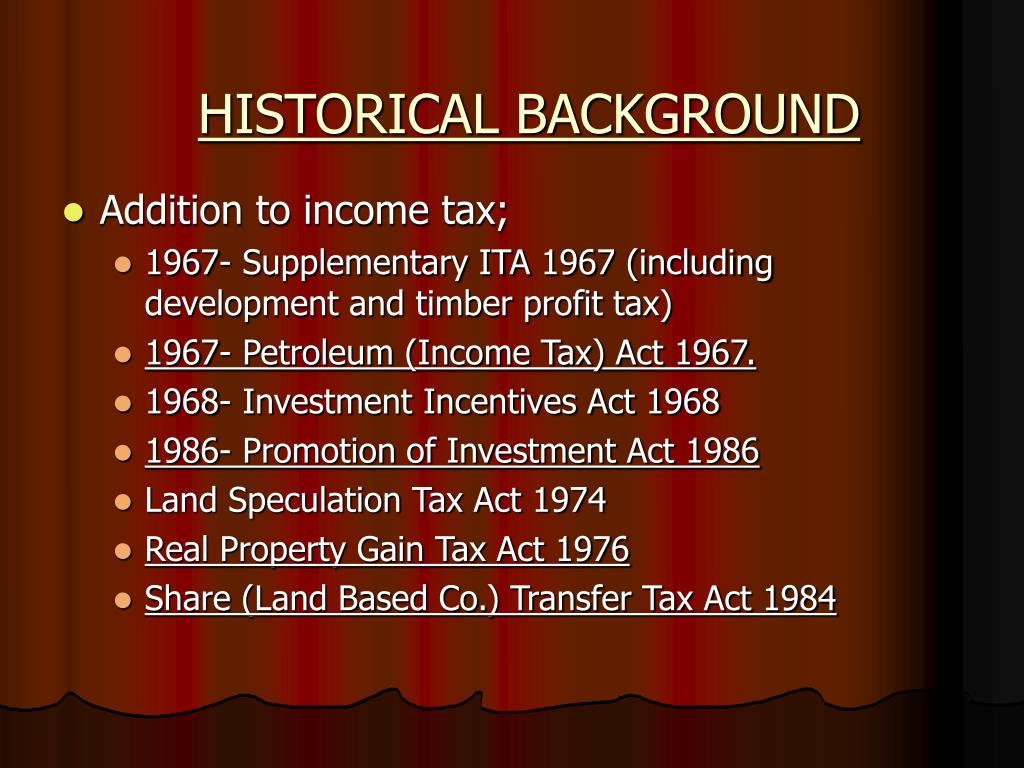

Promotion of investment act 1986. Act 327 promotion of investments act 1986 incorporating all amendments up to 1 january 2006 published by the commissioner of law revision malaysia under the authority of the revision of laws act 1968 in. Act 327 the ministry of international trade and industry miti is currently in the process of reviewing the promotion of investments act 1986 act 327 pia. Investment tax allowance in respect of application received on or after 1 november 1991 29aa.

Be it therefore enacted by the king by and with advice and consent of the national administrative reform assembly as follows. Consideration of pioneer status and investment tax allowance under the promotion of investment act 1986 effective 2 march 2012 general list no promoted product activity i agricultural production 1. Now therefore pursuant to section 45 of the promotion of investments act 1986 and in exercise of the powers conferred by section 3 4 of the investment incentives act 1968 the minister of trade and industry makes the following order. Application for approval for investment tax allowance 26 a.

Dezan shira associates has grown to support 28 offices throughout china hong kong s a r india singapore and vietnam as well as our 7 asian alliance partners in indonesia malaysia the philippines and thailand. The pia was enacted to make provision for promoting by way of relief from income tax the establishment and development in malaysia of industrial services agricultural and other commercial enterprises and for incidental and. Investment tax allowance for application under subsection 26 1 which. Vegetables tubers or roots fruits 3.

Whereas it is expedient to revise the law on promotion of investment. Chocolate and chocolate confectionery 2. Effective from 2 march 2012 new list of promoted activities and products which are eligible for consideration of pioneer status and investment tax allowance have been gazetted under the promotion of investment act 1986.